C:\Takes

Quick takes on trends driving markets

Get the latest take in your inbox

Some believe market valuations are highly predictive of forward returns. We’re skeptical.

A chart circulating widely online suggests we may be in for a zero-return decade. We had reservations about the analysis, which focused on the historical relationship between the S&P 500 P/E ratio and subsequent 10-year forward returns.

In our own work, we found the underlying data to be heavily influenced by a single extreme outlier: the dot-com era from 1998-2002. Viewed through a broader lens, the data suggest that valuation levels alone are a far weaker predictor of long-term returns than the chart implies.

For more on this C:\Take, watch Jason:

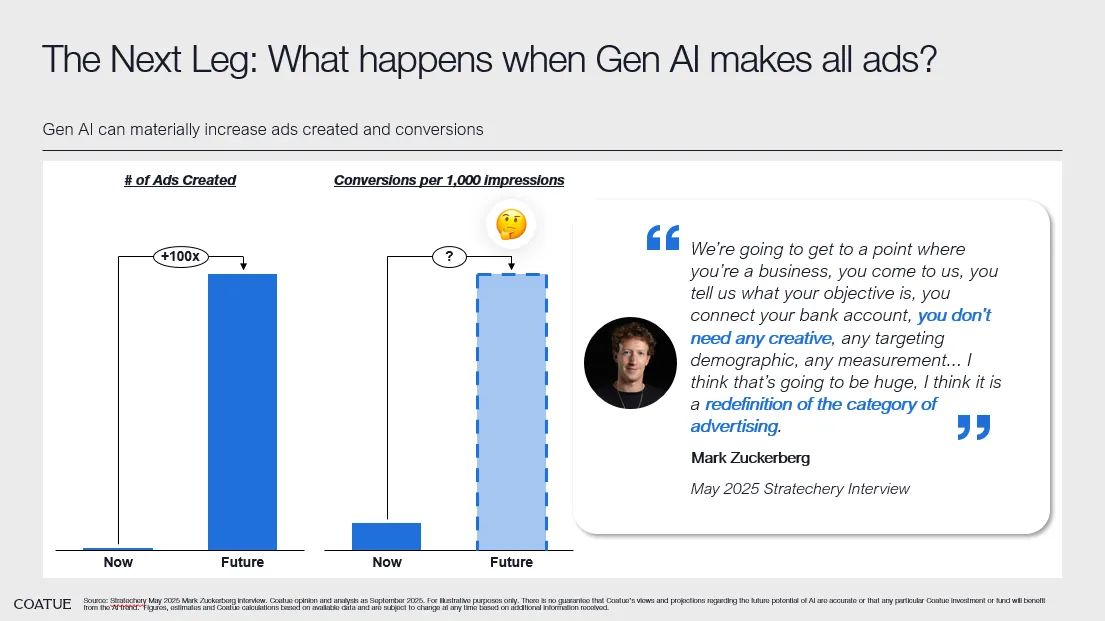

AI is reshaping digital advertising by unleashing a wave of creative supply.

Teams can now generate thousands of ad variants quickly and cheaply. Targeting is getting smarter as Meta, Google, and others push more compute into the ad stack to serve the right message to the right person at the right moment. Feedback loops are tightening: every impression and click trains the system, compounding performance gains. Gen AI boosts the volume and variety of creative, while GPU-accelerated models sharpen targeting and timing. The net result is more relevant ads and higher conversion rates.

Where could this go next? Advertisers will generate far more creative, feeding models that continuously personalize and optimize. Conversion rates should increase meaningfully as models learn which creative works for whom and when. We expect revenue growth to follow — better matches drive more sales.

As AI transforms digital advertising, it’s also reshaping how consumers discover and buy products online. We believe this shift positions e-commerce as one of the major beneficiaries of the AI revolution.

For more on this C:\Take, watch Michael:

Subscribe for the monthly LinkedIn newsletter